I knew him for a while. He landed in Canada 28 years back without a penny. He got a job in the kitchen of a restaurant immediately and earned minimum wage. Any extra money he saved, which turned out to be a lot as he was sharing an apartment with others like him and ate at the restaurant where he worked, he would put towards a Seettu. He also worked part-time at a full serve gas station filling gas in extreme cold weather. Some gentle souls would give him generous tips and he would dutifully put that extra money into Seettu. He depended on Seettu to meet emergency needs: when his wife and children arrived after he sponsored them, he used the money from Seettu to fund their settlement expenses. Some of the money from it went towards a down payment for his house and car. The time has passed, his kids have grown up and moved out of the house and he has higher disposable income now. He still participates in Seettu. Not to meet emergency needs but to make some profit. Welcome to the intriguing world of Seettu, which can be a saving vehicle for some, an emergency lump sum payer for others and profit maker for yet another person.

I have grown up hearing about Seettu since I was a kid. My extended family had used it in some form or other; I would often hear uncles at parties talking about the monthly payment coming up. I did not know much about it, how it worked nor was I interested in finding more about it. Then sometimes back, when I was thinking about vehicles with low correlation to the stock market, a light bulb went off in my head. I started to research the world of Seettu.

Here is one example of how a $10k, 20 month long Seettu with 20 participants, including an organizer, would work. A group of 20 people from different rungs of the economic ladder, with different monetary needs, would get together and contribute $500 each to a pool for a total of $10k in the first month. The first month’s pool would go to the organizer. In the second month, the rest of the 19 people would bid for the pool. Assume a convenient store owner is in need of money because of a severe winter storm. He communicates his bid for $7200 in the second month, the lowest amount among all the bids, and he wins this month’s pool. Each of the 20 participants will have to pay $360 this month ($7,200 ÷ 20 = $360). The next month a participant wants to start a restaurant business and wants to top up her startup capital. She bids $7,000 and wins making every one contribute $350 ($7,000÷20) in the third month. This process continues every month and on the 19th month a participant bids for $9,300 as he has been contributing diligently to the Seettu to buy a new car. On the 20th month, the last leg, everyone contributes $500 and the lump sum of $10k goes to the last person.

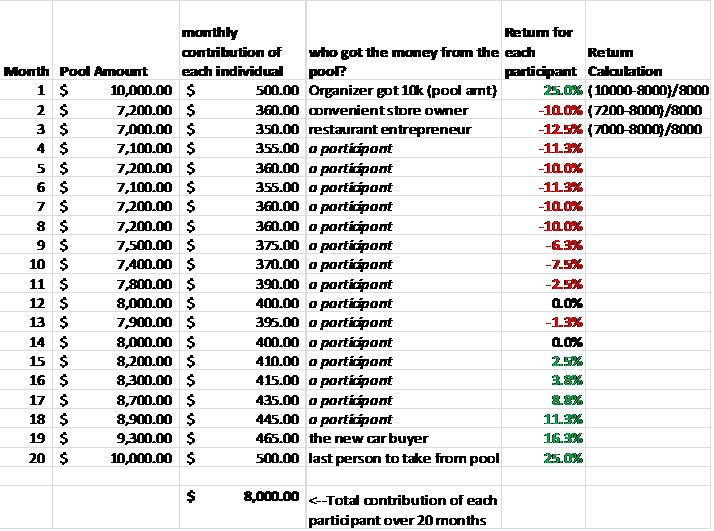

The table below shows the monthly payments and the returns for each individual based on a total individual contribution of $8,000 over 20 months.

In the example above, each participant contributed a total of $8,000 over a 20 month period. However, each participant received a different amount from the pool. So, who won in this Seettu? Everyone. To understand Seettu, you will have to forget about the conventional way of thinking about money and the time value of money. If you look at the rate of return of each participant above, it would appear the organizer got the highest return, followed by the last person and the person who lost was the restaurant entrepreneur. The bigger picture is different: banks would not easily lend money to an unproven restaurant entrepreneur. Seettu acts as an alternative lender without which she would not be able start her restaurant business and the 12.5% interest she paid is still lower than the rate charged by alternative lenders. For the person who bought the car, it was a way of forced monthly saving to buy a vehicle in the future and, to top of it off, getting a good return of 16.3% over the period. For the last person it was a way to earn a profit with her disposable income. In the case of deadlocks when no one wants to take the pooled capital, as waiting out till the end provides a higher return, the organizer would hold a draw to pick the winner. To keep the math simple, I did not incorporate any re-investment of capital in the table above. There are different types of Seettu and the one mentioned here is a common one.

Seettu, like any money related product, is not without its share of risks and troubles. I have heard of someone running away to Vancouver from Toronto with the pooled money. An over borrowed business person on the brink of bankruptcy can bring the smooth running Seettu down. Seettu is not legally binding and therefore there is no recourse for settling any disputes. It is based on trust and overall it has worked well. The organizer plays an important role in making it successful. The organizer would only bring people she thinks is trustworthy, often her friends, relatives or people from her village who would know of their financial history through the grapevine, someone with not more than 2 degrees of separation. This provides incentives for everyone to contribute on time until the end of Seettu or else they would lose face with others and damage their reputation. It is not a get rich scheme. It is simply a mechanism to transfer capital from one set of participants with varying degree of needs to another set with varying degree of excess capital, spread over time to make it manageable and less susceptible to failure.

The Korean community in North America has been using something similar to Seettu called Kye for a long time. It has been credited with them starting a number of small businesses in urban areas throughout North America, often revitalizing abandoned neighbourhoods. I am not aware of other immigrant communities using a system like this.

Nowadays, not many people participate in Seettu as people have established themselves and trust has been replaced by credit scores. The older generation who still participates, does it for fun or for the social aspect a tightknit money club would provide. However, Seettu has served many in the Tamil community well in the past, helping newcomers without credit history and limited language skills establish themselves in a completely a new land. Innovations are sometimes born out of necessity and, in this case, a group of people brought a concept from their old land and employed it to survive and succeed in a new land.

More From This Author:

Here’s How My Neighbour Saved 40K For His 6-Year-Old Son’s Future Education

Ananda Krishnan: The Richest Tamil in the World

10 Tips on Investing for the Future from My Wealthy Neighbour

Ron

Ron